"Affordability Populism" — Cheap Rhetoric, Costly Results

Government attacking private capital won't make life more affordable, even if it scores political points. FREOPP has solutions that will.

President Trump’s recent burst of “affordability” announcements — from proposals to curb institutional investors buying single-family homes to talk of a 10% cap on credit card interest rates — appears to demonstrate commitment to lowering the cost of living for average Americans. But policy theater is not the same thing as lowering costs. These “fixes” won’t attack the root drivers of high prices; in many cases they’ll make life harder for the people they’re meant to help.

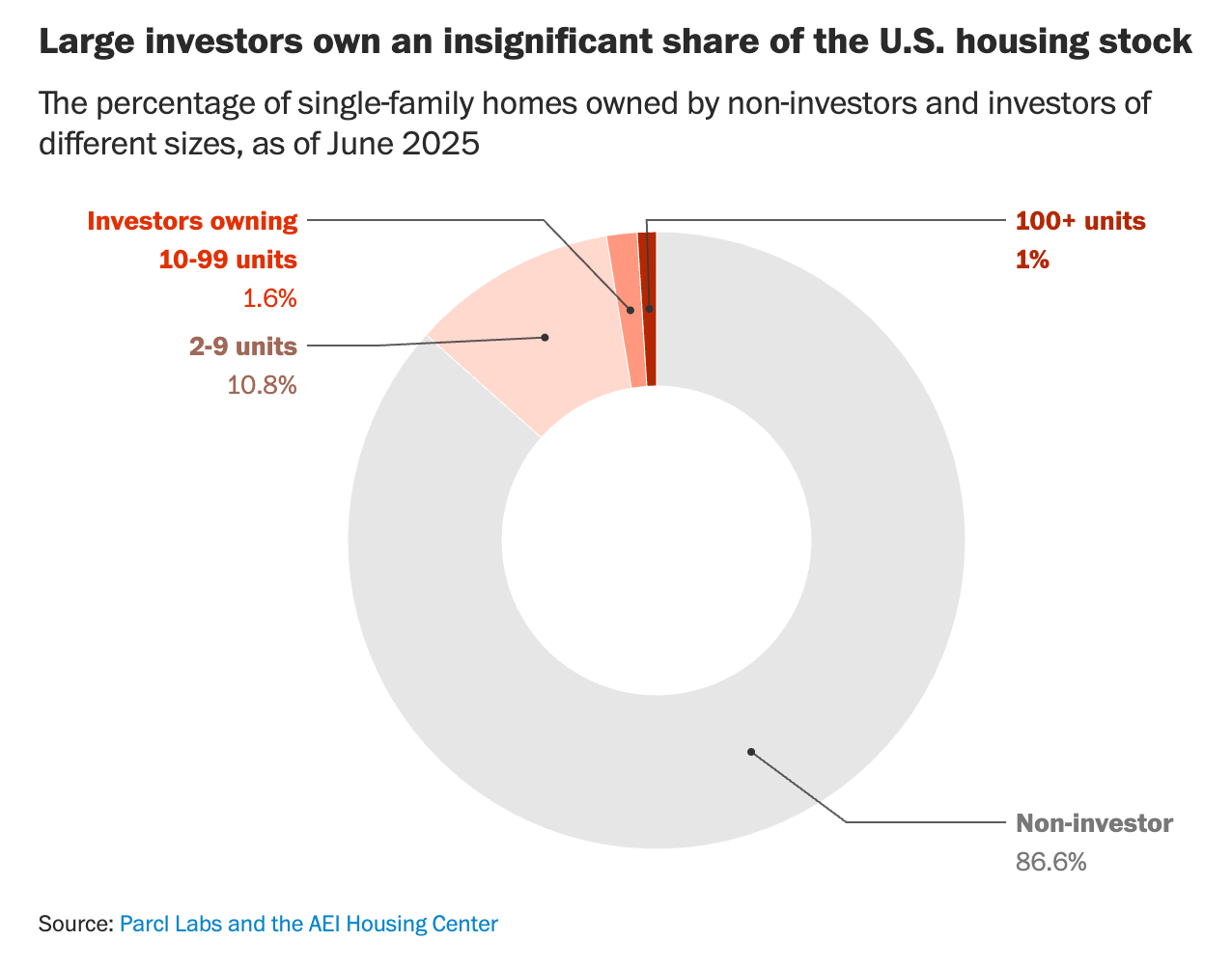

Take the investor ban. It’s politically intoxicating to tell the country that “big investors” are to blame for housing pain. The data tell a different story: institutional owners account for only a tiny share of single-family homes, and in some cases professional landlords expand access to quality, managed rentals. Removing one buyer from the market won’t magically build new housing; it’ll simply shrink a source of rental supply and—crucially—fail to address the real bottleneck: supply.

What actually drives housing costs is what economists have been saying for decades: restrictive land-use and zoning rules that choke supply where demand is highest. Minimum lot sizes, single-family mandates, and density limits make it expensive or impossible to add housing in job-rich, amenity-rich places. If your goal is cheaper housing, the obvious answer is to let more homes be built—by reforming local zoning, streamlining approvals, and encouraging denser, diverse housing types—not by targeting who buys the houses that already exist.

The proposed 10% interest rate cap on credit cards is another example of optics-driven politics with harmful results. Interest rate ceilings constrict credit access for higher-risk borrowers, shrink loan volumes, and push lending into more expensive, less reliable corners of the market. These price controls leave the people with thin credit histories and emergency cash needs worse off — exactly the households a cap purports to protect. Better reforms would expand low-cost credit alternatives, improve transparency, and boost competition in consumer finance.

Another area in which the President is inflicting economic pain on the American people (and political pain on himself) is trade policy. Tariffs are essentially taxes on consumers and businesses; they raise the prices of imported goods and often push up costs across domestic supply chains. Even the administration’s own actions acknowledge this tension: in November the White House rolled back tariffs on more than 200 food products amid growing cost pressures. Empirical work tracking retail prices shows tariffs pass through to consumers over time. If the aim is lower prices for American families, freer trade — not protection via tariffs — is an obvious lever.

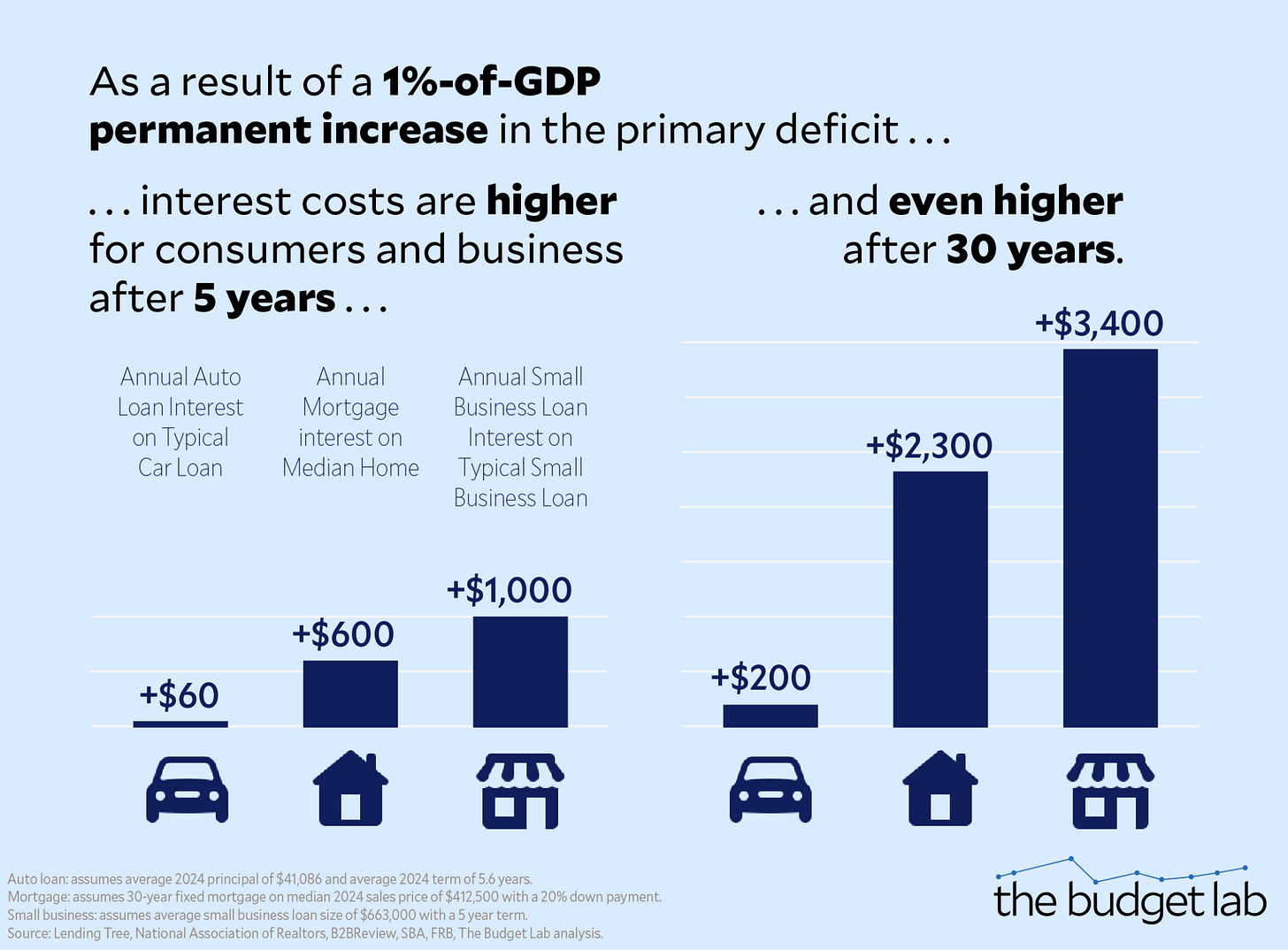

Finally, there’s a bigger, fiscal dimension: chronic government overspending and rising entitlement commitments crowd out growth and add to long-run inflationary and interest rate pressures. The Congressional Budget Office projects substantial deficits and rising debt over coming decades, a drag on growth and a latent tax on living standards. Affordability requires fiscal sanity: reforms that slow the growth of entitlements, preserve benefits for those who need them, and stabilize the balance sheet.

If Republicans want credibility on affordability, they should avoid imitating the class-war theatrics of the left. Progressive “price control” populism has a long record of promising relief but producing shortages, lower quality, and untenable fiscal strain instead. The Trump administration should heed the lesson: steer away from anti-market reflexes and focus on real supply and competition reforms that lower prices sustainably.

That’s precisely the agenda FREOPP has been urging: unleash housing supply by reforming land-use rules; restore competition in health care through the Fair Care Act’s market-focused reforms that also rein in entitlement spending; modernize energy policy around abundance, affordability, and reliability; and embrace free trade to lower costs for consumers and open new markets for American producers. Those are the policies that bend cost curves down and create upward mobility for ordinary families, rather than just reshuffling burdens.

Political theater can win headlines; evidence-based free-market policy wins pocketbooks. If the goal is to make life more affordable for struggling Americans, Washington needs to swap the optics for supply, competition, and fiscal responsibility. Build more homes. Make hospitals compete. Reform entitlements. Keep markets open to trade. Do those things, and we’ll actually lower costs — not just score a 15-second sound bite that won’t even last until the midterm elections, anyway.

In freedom,

Akash Chougule, President